We can talk about saving all we want but talking certainly won’t make any change, it is time to do something about it! We have reached level three in the aggressive and meanwhile level one and level two focused understanding our potential to save and becoming more aware on what we spend our money on and what we want to spend our money on, level three is about taking action. To refresh our memory of the main highlights we will recap the main parts. If you feel that you already have everything fresh in your mind, feel free to jump to the action part.

Aggressive Saving

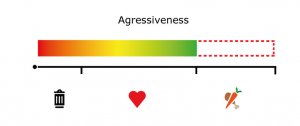

First of all, what is aggressive savings training? The aggressiveness of the saving is all about how much you save in relation to your full capacity of saving. As we talked about in level one, your full capacity is if you only, with no exceptions, spend on necessity expenses, expenses you have to pay to live. The purpose of this training is to go crazy and more aggressive than you normally would. This training is not a life commitment so don’t be shy and try to go more aggressive than you feel comfortable. You have nothing to lose and you will definitely not lose money by trying.

How aggressive do you aim to be on the aggressiveness-meter? Which types of expenses and how much are you willing to cut out to reach a higher savings level?

Types of Expenses

Let’s refresh our memory on the different types of expenses. There are three and by regulating the amount we spend within each and reallocating our spending we can both save more and live a more fulfilling life.

Necessity Expenses – Expenses you have no choice but to pay for your daily life. Typical examples are rent and food and gourmet food is not included here.

Want Expenses – These are expenses that gives you added value in your life. It can be different levels but has to give some kind of value. If I love music paying for piano classes would be an example of a want expense.

Waste Expenses – These are all the expenses that has little to no impact on your life. It can be confused with want expenses because it might add some value, but the value is so small or so short term (up to 1 hour for an ice cream) that it is insignificant and just a “shallow” value. These expenses are fun (short term), but not worth it compared to what you could do with the money saved.

What Do I Value?

We all want to enjoy life and a good way to do that is to use our money on what we value the most. To be able to do that we need to know what we actually value and some reflection is needed to identify that. There are two sides, why do we want to save and what’s the value in it? How much do we value the things we spend money on? If we know the value for us we also have guidelines on when we should spend and when we should save. What we value is personal and it’s obvious for us but completely different for someone else. What works for you in terms of a saving method is therefore personal. To make it easier, instead of focusing on restricting yourself from spending, focus on increasing the enjoyment in life using money as a tool investing in what gives you more value.

Are You Ready to Sacrifice?

If you are in a position where you need or want to save more it means you need to sacrifice some expenses. By starting with sacrificing the waste expenses it’s not really a sacrifice. It will be a win – lose situation whatever you do where spending wins and saving loses or the other way around. One of the sides will have more value and if you cut the waste expenses you are giving the win to savings which gives you the bigger win since there is more value on that side. If you go aggressive you need to sacrifice some of the want expenses. We can’t have all in life but what we can do is to choose the best of the best. Like I said, it’s not a life commitment so we are not giving up on everything forever, just temporarily so we can enjoy the benefits of saving.

Are You Ready to Go Aggressive?

Over the course of three weeks you will go through different levels of aggressiveness and in the process why you want to save, what you value and you’ll not only talk about but also experience the impact different levels of saving has on you and your savings. To enhance your experience use this free printable to help you structure your thoughts, reflections and your experience.

What are we waiting for? Let’s get started!

Week 1

Task:

- Look through your monthly expenses and identify which expenses are necessity, want and waste. Remember that one category of expense can have several types of expenses, for example the necessary amount of food will be a necessity expense and making a fancy expensive meal could go into want or waste.

- Set your savings goal and identify why do you want to save?

Saving:

- Cut all waste expenses.

Week 2

Task:

- Review your want expenses and identify how much value each expense gives you.

Saving:

- Only spend money on the want expenses that gives you higher added value (cut out all medium or low value).

Week 3

Taks:

- Evaluate your experience from the previous weeks and at the end of this week, how is your life different with the different levels of savings? How does it affect you?

- End of week: how do you want to spend and save your money in your daily life in the future?

- End of week: what is required from you to reach your savings goal?

Saving:

- Go crazy!! Aim for full aggressiveness in your savings (no waste and no want expenses). It is only one week, you can do it!